|

Dr Shaimaa MasryDoctoral Program Student (January 2008 - June 2013)Centre for Computational Finance and Economic Agents (CCFEA) University of Essex Email @essex.ac.uk: smhmas Microscopic Analysis of the FX Market

Shaimaa works on the High-frequency Finance Project. Shaimaa conducted a microscopic analysis of traders’ behaviour in Foreign Exchange (FX), to enable us to understand, define and measure the different forces driving the FX market. This analysis was based on anonymised data provided by OANDA. She followed the approach by Richard Olsen (Visiting Professor at CCFEA). For her PhD, Shaimaa produced a simulator to demonstrate the market dynamics in double auction markets. This demo won Shaimaa the David Norman Prize. Following is the abstract of Shaimaa's thesis:

The foreign exchange (FX) market is the largest and most liquid financial market in the world. Like the centre of a spider web, the foreign exchange market connects to all other financial markets around the world. It is a global network that allows its participants to trade 24 hours 5 days a week from different geographical locations. Given this unique nature of the FX market, millions of daily tick data, referred to as high frequency data (HFD), are generated as a result of market participants' decisions and interactions.

To understand market dynamics, our approach is to explore the microscopic world of the FX market by analysing in depth the millions of daily tick-by-tick prices and the micro-behaviour of FX participants, which in turn formulate a collective market macro-behaviour. This thesis conducts its analysis using an event-based approach. Events are actions taken by traders in the market. We carry out three studies with the aim to get an insight into how these events drive the FX market. With these studies, we aim to make general inferences about market behaviour. The first two studies are empirical research based on analysing a unique high frequency real transaction data set of FX traders, whereas the third study formalises the market micro-dynamics.

To prepare for our empirical studies, we have produced, to the best of our knowledge, the biggest set of HFD ever, which comprises tick transactions carried out by over 45,000 FX traders on an account level for over 2 years. In addition to cleaning the data set from any erroneous observations and validating the quality of the data, we show that the data set is indeed representative of the of the global FX market. This confirms the reliability and validity of this research results. This data set is invaluable to future researchers.

The first empirical study tracks and analyses the FX market seasonal activity from a microscopic perspective, using the tick transactions of the HFD produced. We provide empirical evidence that the unique signature of the

FX market seasonality is indeed due to the different time zones market participants operate from. However, once normalised using our custom-designed procedure, we observe a pattern akin to equity markets. Thus, we have revealed an important FX market property that has not been reported before.

The second empirical study conducts a microscopic analysis of FX market activity of the produced data set along price movements. Given the high frequency and irregular nature of FX tick data, we adopt an intrinsic time scale approach proposed by Olsen Ltd. Intrinsic time is defined by exchange rate turning points of a pre-specified threshold, which are called directional change events. We provide empirical evidence for decaying market liquidity and price ticks changes at the end of the price movement, the overshoot period. We find that a price overshoot stops due to more participants placing counter trend trades. The overshoot period is of special importance as it measures the excess price move of a given threshold and indicates the extent of imbalance in the market for the specified threshold. To our knowledge, this is the first study that deciphers FX market activity during price overshoots. It lays the foundations for understanding how FX market activity changes as the price movement progresses and how small imbalances of market activity in large overshoots can alter the price trajectory.

The third study formalises market dynamics using calculus. In this approach, we define the different market states mathematically and demonstrate the consequences of placing an order into the market. This calculus enables us to analyse market dynamics and properties scientifically. For example, it allows us to study feedback loops, which account for the full effects of cascading margin calls. It also allows us to compute how big a sell order has to be to cause the market to fall by a certain percentage in a simple double auction market model. This work demonstrates how market dynamics and properties can be studied rigorously. It lays a solid foundation for extensive scientific analysis of complex market models.

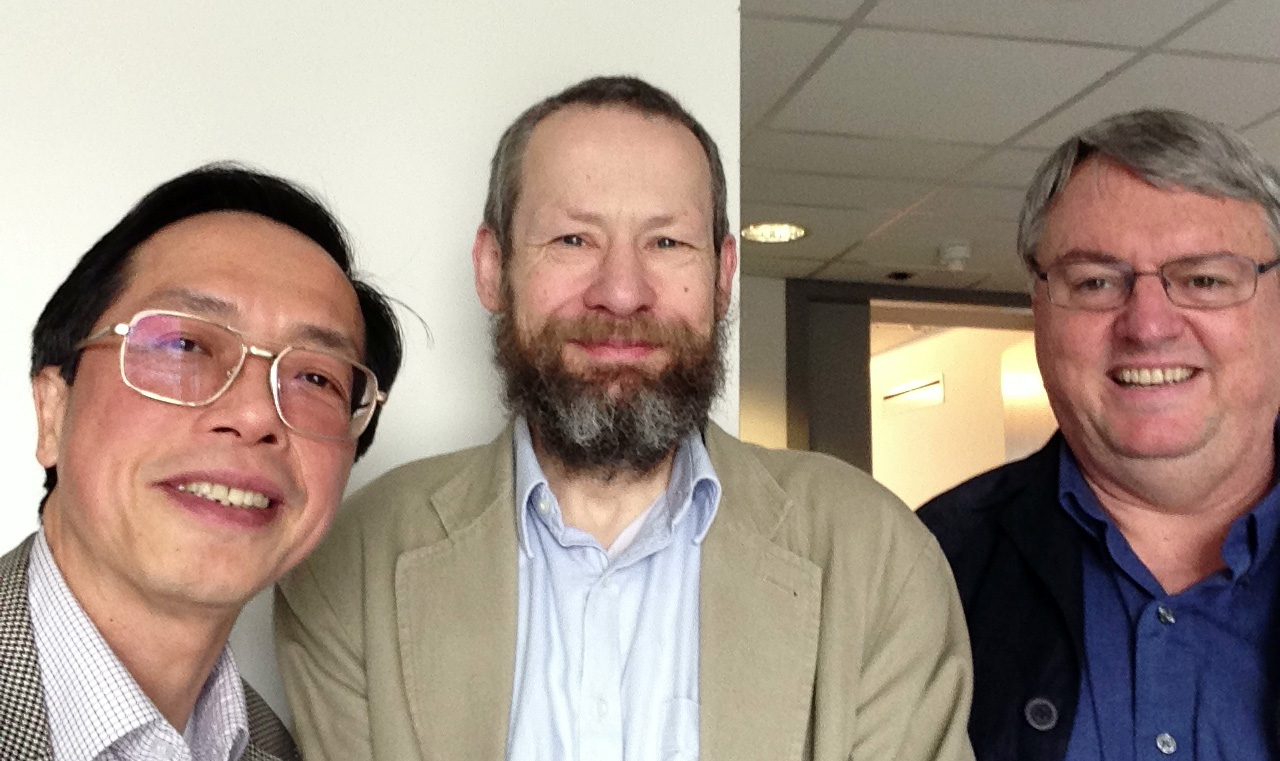

Shaimaa was jointly supervised by Edward Tsang (CCFEA),

Richard Olsen (Visiting Professor) and

Alex Dupuis (Visiting Fellow).

She was examined by

Peter McBurney (External Examiner) and

Sam Steel (Internal Examiner).

She passed her viva on 10th June 2013 with no corrections required.

This work is related to but independent of Monira Al-Oud's work. Maintained by Edward Tsang; updated 2013.10.18 |

|---|